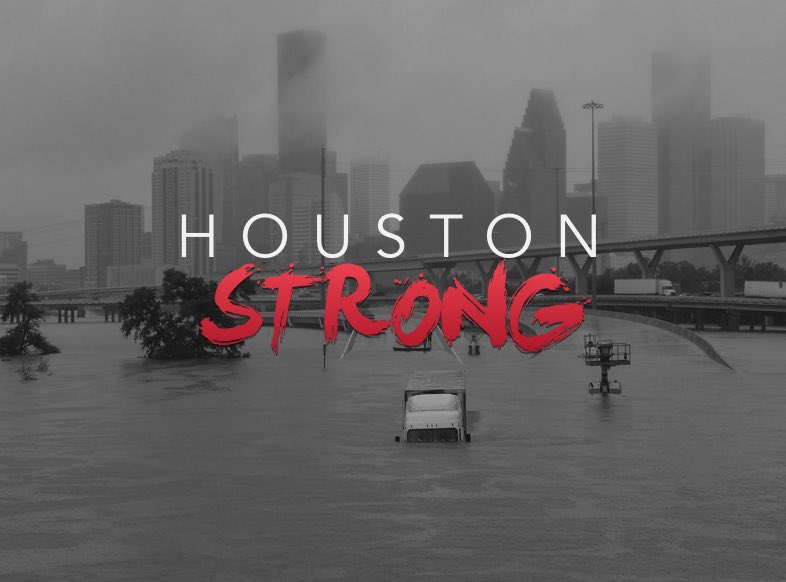

Reviews From Hurricane Harvey Victims

Check out what our clients in Houston had to say about their experience with us after Hurricane Harvey

“Consistently Excellent!”

– Cap’n Rick

“My original leased vehicle with D&M became a victim of Hurricane Harvey and was totalled by my insurance. I contacted my D&M agent, Lee Bowles and informed him of the situation and my specs for a replacement. By the next morning, Lee had sent me photos of a perfect replacement vehicle, worked out a way to minimize my cash outlay and, ultimately found me TWO additional vehicles which were new and guaranteed flood-free! In a disaster-stricken area with not even rental cars available D&M found me three vehicles which would fit my needs!! As soon as my insurance company had officially processed my claim, my new car was delivered to me at home the same day. During this wait, Lee was in constant contact with me providing updates as discovered. D&M has also incorporated online paperwork which made the whole process that much more streamlined. All things considered, I cannot imagine ANY leasing company that could have been more responsive, provide better customer service and (more importantly) RESULTS, than D&M. You are doing yourself a disservice if you don’t give them an opportunity to provide your next vehicle!”

“Great Experience “

– Cheeks2106

“Darrel Williams and Troy Killian took great care of us and got us into a vehicle quickly after we lost both to Hurricane Harvey. Love our new car and are excited to start looking for another car. Would definitely recommend this company and Darrel to anyone who is looking for a vehicle!!!”

“Life savers!”

– Anonymous

“The vehicle I was leasing with D&M was flooded during Harvey and totaled by my insurance company. George and Darrell bent over backwards working tirelessly to get me into a car that I love. My second lease with D&M, and second time they’ve come through big for me!”

All those affected by Hurricane Harvey will have no down payment and make no payments for 90 days. We want to make getting a new car easy for you so that you can focus on everything else.